CVS Health and Walgreens: Go Short or Go Long?

Published 10:00 am Thursday, June 8, 2023

- CVS Health and Walgreens: Go Short or Go Long?

The investment environment for almost all of 2023 has been dominated by megacap tech stocks.

Apple (AAPL) – Get Free Report, Meta (META) – Get Free Report, Nvidia (NVDA) – Get Free Report and others have been powering higher. That’s helped elevate the S&P 500 and Nasdaq, while other stocks have struggled.

Now we have a rotation underway, with small-cap stocks surging and a handful of other sectors finally catching a bid. One of those sectors? Retail.

Don’t Miss: Did Palantir Stock’s Momentum Just Run Out?

The retail sector — whether viewed anecdotally or via the SPDR S&P Retail ETF (XRT) – Get Free Report — has not done well this year. Despite a one-week 10% rally, the XRT is up just 1% so far this year and is down more than 8% over the past 12 months.

Within that group, CVS Health (CVS) – Get Free Report and Walgreens (WBA) – Get Free Report have struggled badly.

CVS stock is down 23.5% this year and almost 26% over the past 12 months. Walgreens stock is better, but down 15% in 2023 and 26% over the past year.

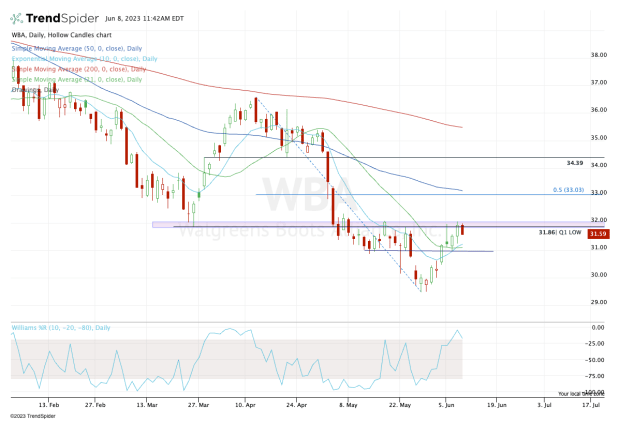

Trading CVS Stock

Chart courtesy of TrendSpider.com

Short-sellers like the setup in CVS stock. That’s as the shares ram into the first-quarter low near $72, along with the 10-week and 50-day moving averages.

If this were the opposite setup — CVS pulling back into the Q1 high, along with the 10-week and 50-day moving average combo — traders would be buyers in the scenario.

Don’t Miss: Tee Up Topgolf Callaway Brands or Take Profits?

Further, CVS has been a relative weakness leader. So the setup is a bit precarious for longs, especially if the shares trade back down into the short-term moving averages and can’t find support.

A break of $70 pushes CVS below the 50% retracement of the recent rally, as well as the 10-day and 21-day moving averages. That opens up $67.50 and $66 on the downside.

As for the upside, a move over $72 opens the door to the 61.8% retracement up near $74, then potentially puts the $77 zone in play.

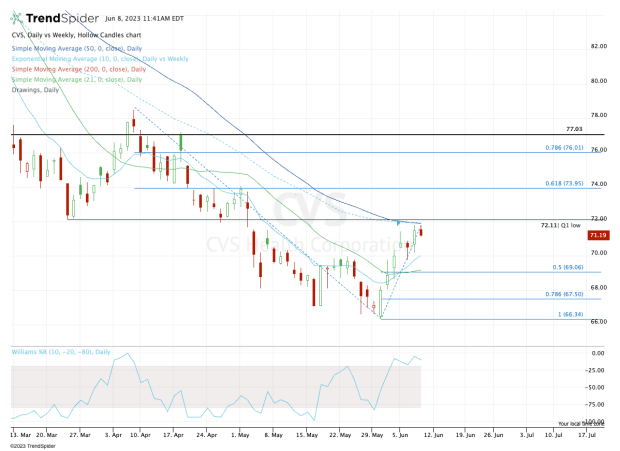

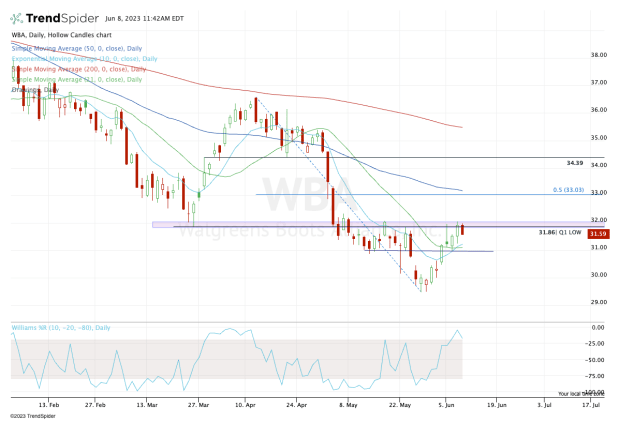

Trading Walgreens Stock

Chart courtesy of TrendSpider.com

Walgreens stock has a similar setup, as it rams into its first-quarter low but remains well below the 50-day moving average.

The bulls need to see Walgreens stock clear this week’s high at $32.05. If it can do so, it opens the door to the 50% retracement and 50-day moving average near $33. Above that puts $34.50 to $35 in play.

Don’t Miss: How Far Can SoFi Stock Rally? Chart Provides a Clue.

From a technical perspective, Walgreens stock is okay if it can stay above $31. A break of this level puts the stock below recent support, as well as the 10-day and 21-day moving averages.

In that case, $30 or lower could be on the table.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.